Corruption in the oil, gas and mining sectors causes significant harm to people and the planet.

To empower anticorruption actors to identify, understand and act against

extractives sector corruption, the Natural Resource Governance Institute (NRGI)

has developed a seven-step process to support effective research and advocacy.

This digital version of the tool helps users quickly understand the different steps

and learn from the experiences of those who have already gone through the process.

What does the tool do?

The tool is a flexible and adaptable seven-step guide that helps users engage on sensitive topics, identify and understand major corruption issues, and build and implement action plans for reforms to prevent corruption in the future. Users should leverage existing resources and expert stakeholder inputs to identify key areas of risk, while involving a broad set of stakeholders from the outset will help strengthen findings and ensure buy-in for reform. Users decide at the start of the process if they want to get the support of an independent researcher for Steps 2 and 4, with detailed guidance on this in the full diagnostic tool.

Fighting corruption can be an overwhelming task, so the tool helps users break down anticorruption ambitions into manageable parts, addressing both risk factors and underlying causes. These include measures to enhance transparency, strengthen oversight and participation, promote integrity, reform institutional and regulatory processes, increase fair competition, strengthen the enforcement of rules, and address foreign enablers.

Step 1:

The process begins with the user selecting a specific sector or commodity to assess and defining a set of goals which describe the motivation for conducting this corruption diagnostic. This step should be brief and not require any in-depth research. In most cases, the decision can be made at a single meeting convened by the user. Such a meeting can involve different stakeholders to ensure early buy-in in the process.

Choosing where to focus and setting goals

In this step, the user decides where to direct its focus. This should be on a specific sector (oil and gas or mining) and could choose to look at a specific commodity or group of commodities (such as gold or transition minerals) within this sector. The user should also decide the governance and/or geographic level of focus (such as national or subnational). Factors influencing selection could include evidence and perceptions of corruption, momentum around reform, and the current or future economic importance of the sector or commodity or its environmental and social impacts. The user should identify up to three broad goals that motivate the study, which relate to the key priorities and pressing issues in the sector. The user should also think about key stakeholders to involve in the process as early as possible by drawing up a list of key relevant actors.

Step 2:

In Step 2, the goal is to summarize relevant existing data about the corruption and governance challenges in the chosen sector in a brief report. This creates a shared body of background knowledge and helps the user decide where to focus more in-depth research. This step should take roughly 10 days.

Supporting workbook to review existing data

Reviewing existing data

- Compile existing materials, including sector data from countries, companies, and EITI reports, governance indices, information on past corruption cases in courts and the media, and country-specific corruption and governance reports.

- Answer questions about each area of focus that cover how significant this area is (now or in the future), how harmful corruption is or could be in this area, and how realistic are the opportunities for positive change. Not all areas of focus will be relevant, for example some focus only on mining or fossil fuels or deal with specific types of mining such as ASM.

- Write a 10-15 page summary report that brings together the most important information.

To answer the questions in detail, the user should use the downloadable workbook.

Click to expand

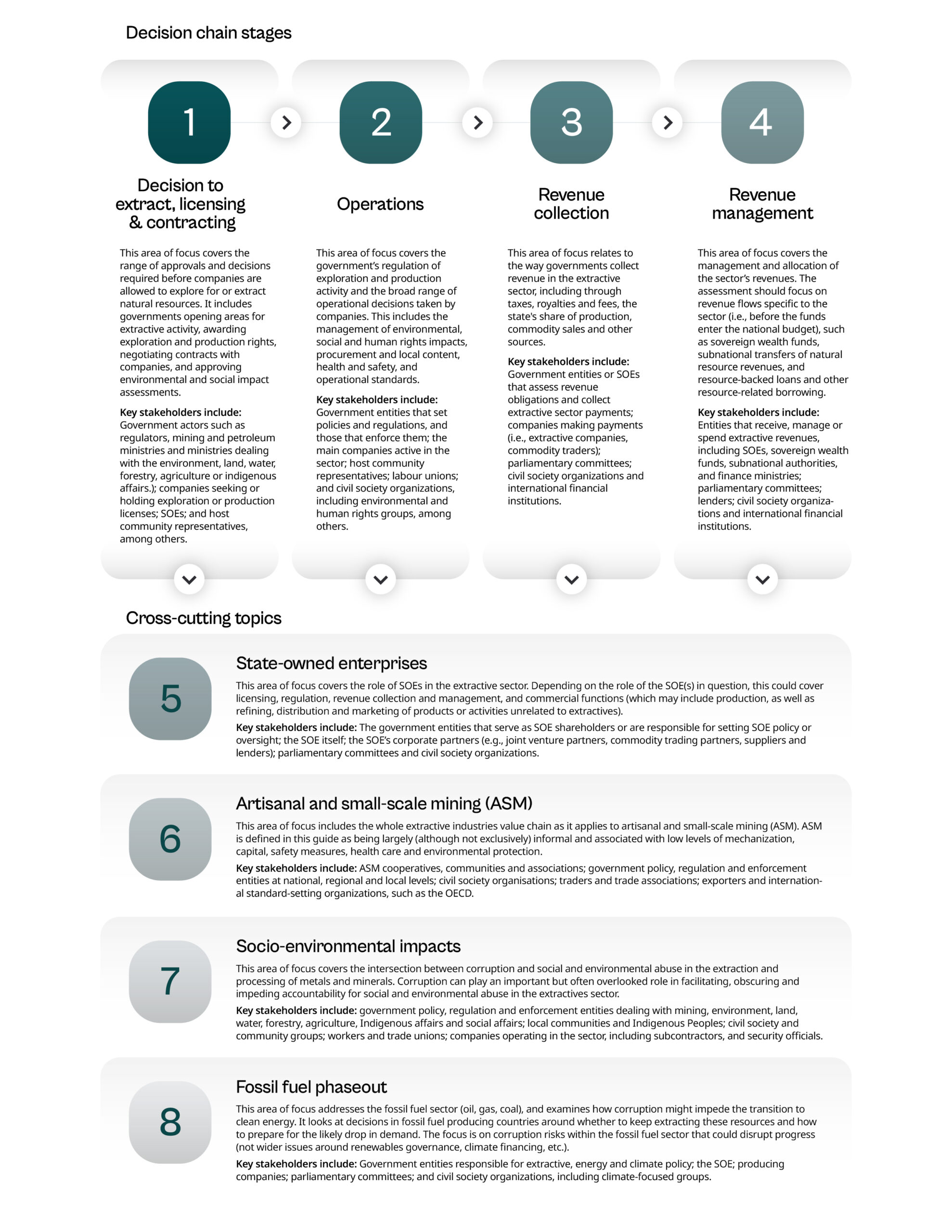

Decision chain stages

Step 3:

In Step 3, the user identifies a couple of areas of focus for in-depth analysis and action. This is an opportunity to bring together different stakeholders on board.

Deciding where to focus

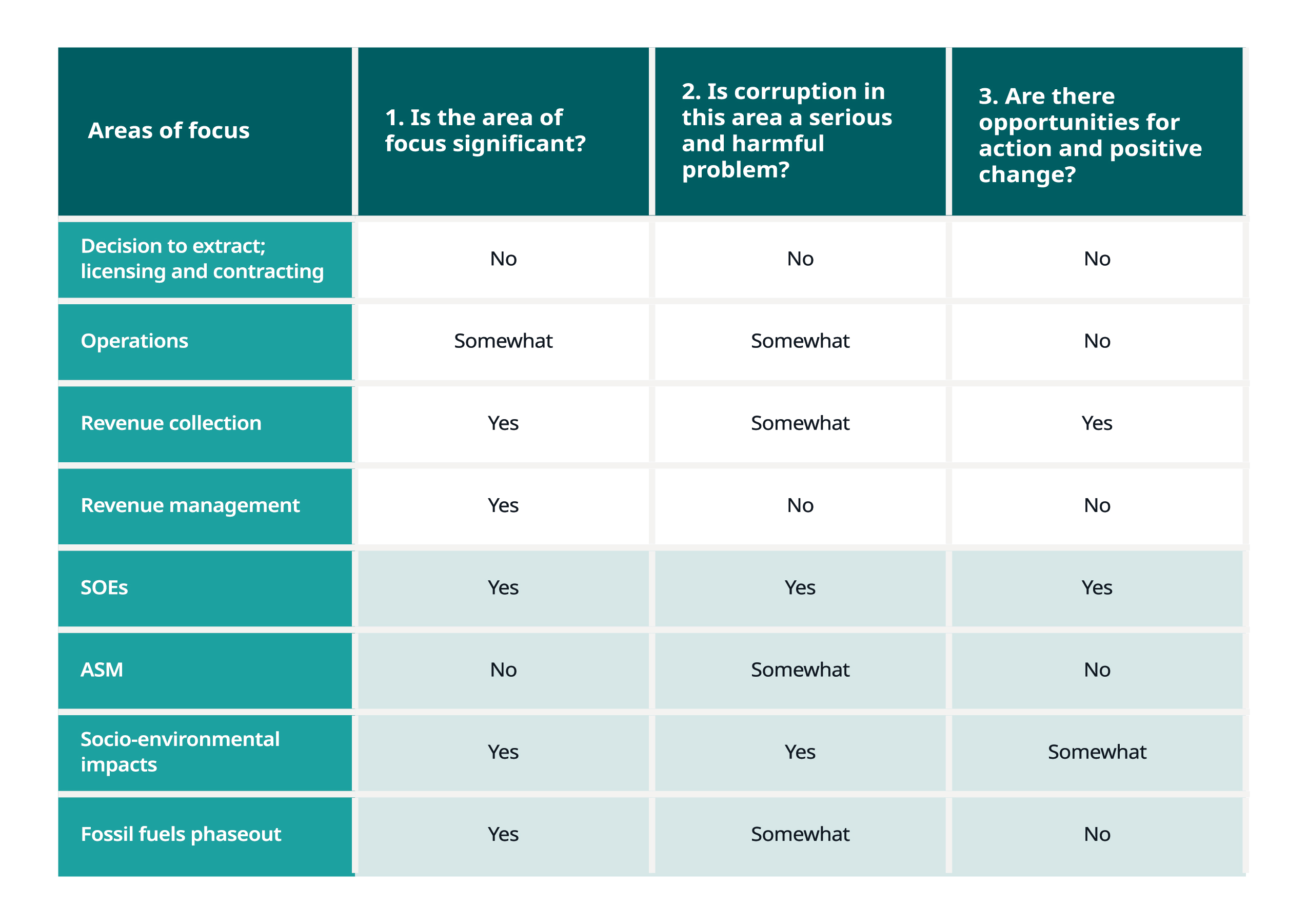

Based on the research carried out in Step 2, the independent expert should complete a draft selection table which answers if the area of focus is significant, is serious and harmful, and if there are opportunities for positive change – answering ‘yes’, ‘somewhat’, or ‘no’ for each as in the example below.

Click to expand

Illustrative selection table

Step 4:

In Step 4, the independent expert conducts primary research into the selected areas or topics of focus to understand the leading forms of corruption, why they arise, and anticorruption steps that could help prevent them, writing a report and completing an initial draft of a diagnostic table. This is one of the most time and work-intensive steps, taking a minimum of two months.

Thematic research guides

Developing a research plan and conducting in-depth research

First, the independent expert should develop a research plan which matches the time and resources available. Possible sources of information would include interviews, focus group discussions, further desk research, and/or an online survey.

The following considerations may help with your research:

- Be flexible and tailor the approach for each interview based on your findings.

- Keep the end goal in mind and ask stakeholders about how they think issues could be resolved during interviews.

- Try to triangulate findings by confiming information with multiple stakeholders.

- Find insiders who can address the specifics and have direct experience with the processes you are looking at, including former employees.

- Gather the insights of women and marginalized groups.

- Offer and respect confidentiality to ensure that interviewees feel safe and comfortable to participate.

- Choose language carefully, highlighting that the exercise is not an investigation but about preventing future corruption.

- Avoid making accusations, taking care in describing allegations of corruption given the potential legal repercussions.

- Secure high-level support where possible, for example from a senior official overseeing EITI.

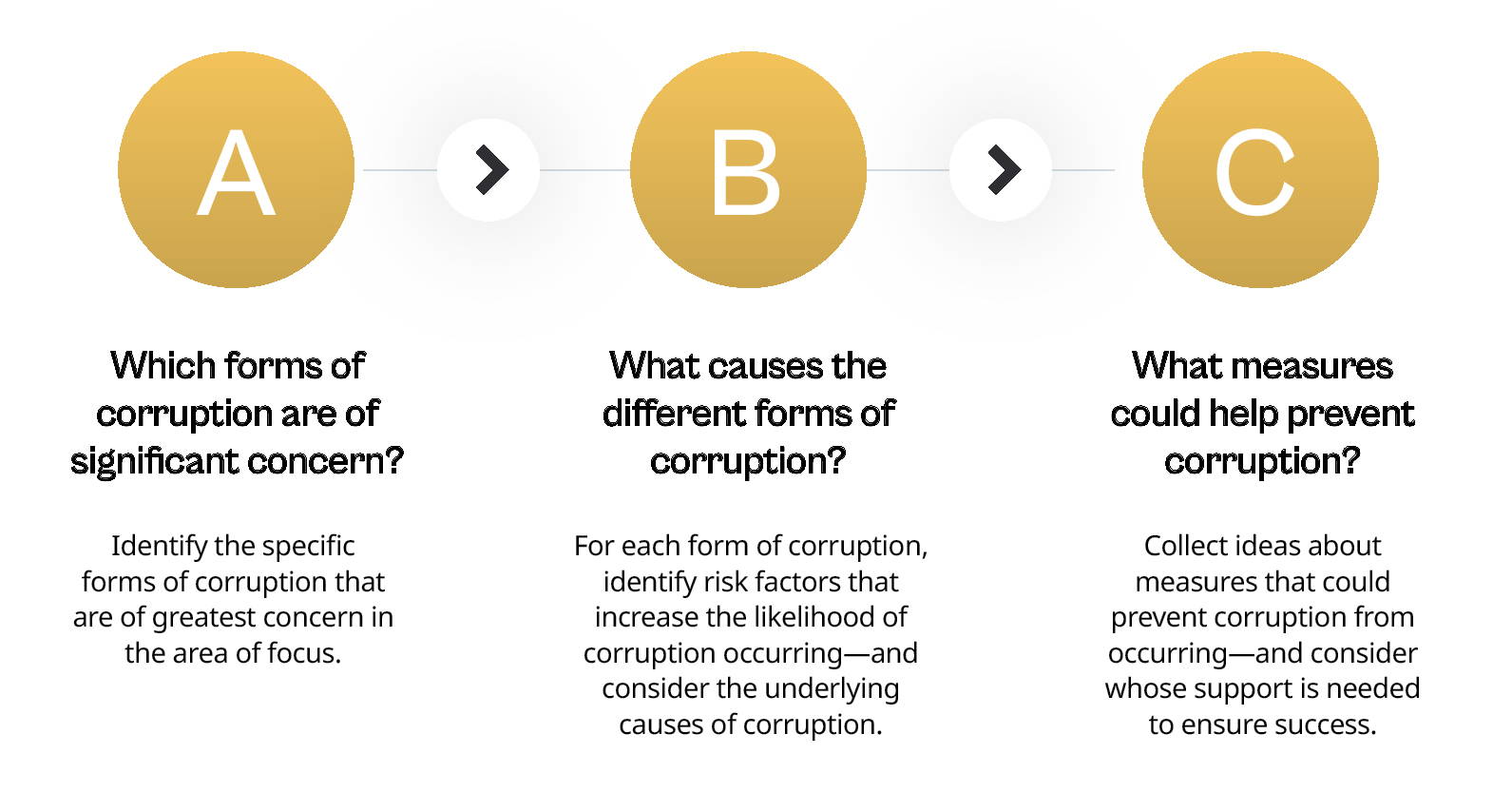

Using this data, the independent researcher should answer the three following questions:

Step 5:

In Step 5, the user brings together different stakeholders to prioritize forms of corruption identified in Step 4. One of the best ways to do this is through a workshop.

Prioritize forms of corruption for action

Based on the independent expert report and a draft priorization table prepare by the expert, stakeholders discuss the findings from Step 4 and agree on the leading forms of corruption to address, with a maximum of 10 to ensure that the process is manageable. It is not necessary for there to be consensus in this process – loose agreement is enough.

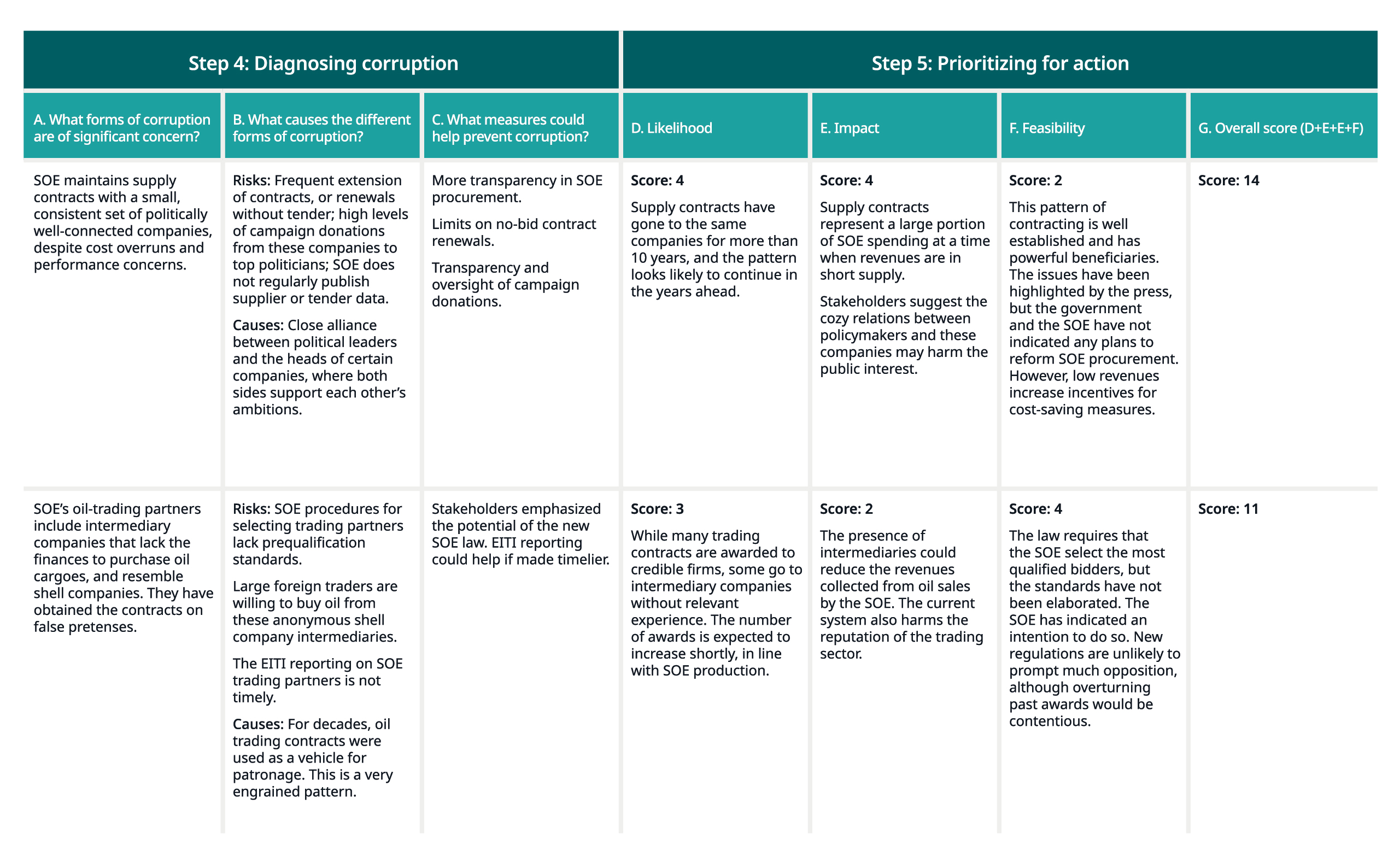

With the forms of corruption agreed upon, stakeholders prioritize based on three categories: their likelihood; their impact; and the feasibility of positive change. In answering questions on these topics on a scale of 1 (low) to 5 (high) and doubling the score for impact, the user and the different stakeholders can better understand where to focus their attention. See below for an example diagnostic table.

- Likelihood – Has this form of corruption been prevalent in the past? Is it likely to be in the future? Do developments in the sector make this impact more likely?

- Impact – Will reducing corruption have a large positive impact on citizens? For example by reducing economic losses, disrupting harmful political practices, reduce negative social and environmental impacts, reduce inequalities and exclusion, improve efficiency of the sector, or remove barriers to the just energy transition.

- Feasibility of positive change – Is there momentum or specific reforms already underway? Is there a risk of duplicating existing efforts? Is there support for reform from key stakeholders, including internationally? Would the beneficiaries of corruption try to block reform?

Step 6

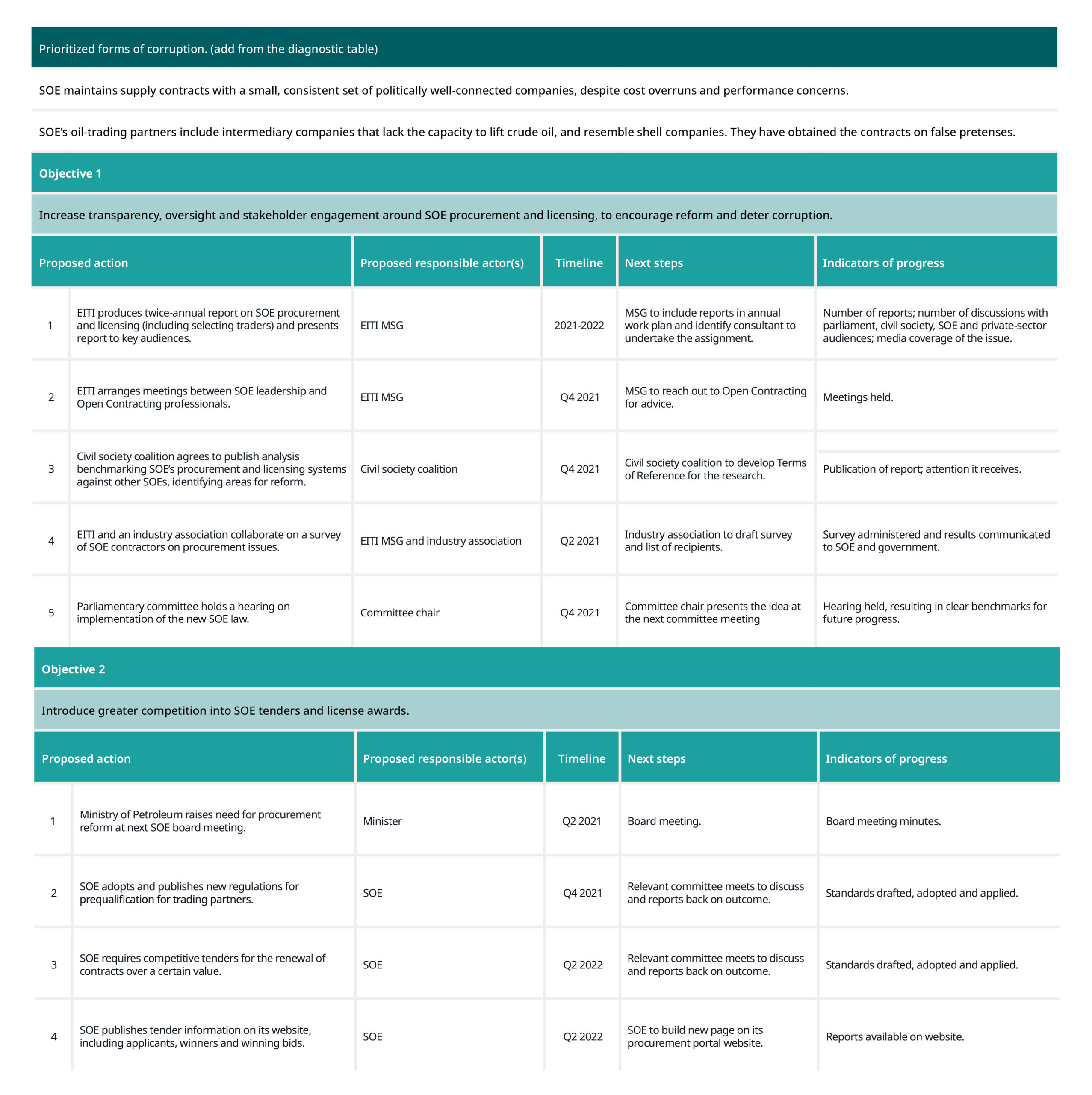

In Step 6, all of the analysis is brought together to inform an evidence-based action plan, supported by a strategizing and objective setting process.

Developing a successful action plan

Developing a successful action plan requires thinking strategically about how to best achieve impact. This should involve careful consideration of strategic questions, such as how many forms of corruption to tackle, how to keep momentum whilst also tackling high-impact issues, which key individuals and agencies to involve and incentivise, how to best align with existing reforms, and how to talk about your work.

The user should set clear, specific objectives that build-in flexibility to the process and select specific actions that fall under these objectives, identifying who would be in charge of implementing these and a tentative timeline (and resources if needed). This action plan should also be inspired by the different categories of anticorruption reforms outlined in the getting started section, but can also be informed by experiences from other sectors. See below for an example of what this could look like.

Step 7:

In Step 7, the user devises a dissemination and advocacy strategy to share the findings of the diagnostic process, support implementation by relevant actors, and monitor progress in implementing the agreed action plan.

Understanding decision makers’ priorities and advocacy

To secure buy-in for the action plan, the user should ensure that they understand decision makers’ priorities. This is especially important if it has been difficult to involve government and/or company representatives in the diagnostic process. Before deciding on how best to disseminate findings and advocate for actions, it is important to understand the policy positions of decision makers, the network that influences them, and any actors who may be opposed to your actions.

With this information, the user should then devise a dissemination and advocacy plan. This plan should consider whether decision makers were involved in the diagnostic process, what opportunities there are to share findings, what advocacy tools can help keep the issue of corruption on the political agenda, what media outlets do key decision makers read or listen to, and how to use social media.

For all dissemination and advocacy plans, the user should consider whether a more public approach will benefit or hinder advocacy efficiency. Some decision makers may respond better to formal, technical outreach, whereas others may respond to increased public attention on the issue of corruption.

Monitoring and follow-up

Regular follow-up is needed to successfully implement the action plan, and the user should be ready to adapt the plan in the face of changing circumstances. The user may wish to convene periodic meetings among the key collaborators to assess progress. If resources allow, users may wish to hold further follow-up workshops, six months or one year after the action plan was agreed, to assess progress, retain stakeholders’ interest and adjust plans as necessary in response to political opportunities or developments.